Eventually You Will Exit Your Business: Plan early for the best outcome with Julie Keyes #085

Show Notes:

Are you prepared for the day you exit your business? Many owners aren’t, risking their hard-earned nest egg by waiting too long to plan their departure. In this eye-opening episode of the Dealing with Goliath Podcast, we dive into the critical yet often overlooked aspects of exit planning. Discover the optimal timeline for a smooth transition, common pitfalls to avoid, and actionable steps to ensure your business thrives even in your absence.

Host Al McBride welcomes Julie Keyes, a certified Exit Planning Advisor and founder of Key Strategies, who shares her extensive experience and insights on maximizing exit and transition options for business owners. Whether you’re contemplating selling soon or years down the line, this episode is a must-listen. Join us and take the first step towards securing your legacy.

GUEST BIO:

Julie Keyes is a Certified Exit Planning Advisor and the founder of KeyeStrategies, specialising in exit and transition consulting, leveraging her extensive entrepreneurial experience. Understanding the challenges of ownership, she aids business owners in maximizing their exit and transition options.

Julie is deeply involved with the Exit Planning Institute, contributing as a faculty member, a Leadership Council member, and is a two-time recipient of EPI’s “Thought Leader of the Year” award.

She is a sought-after speaker, and in 2021, she released the 2nd Edition of “Poised for Exit,” a practical guide for private business owners on the business exit process, complemented by her weekly podcast available on major platforms, offering insights for business owners and advisors.

She has also developed an online course, “Business Transition Readiness: An Owner’s Guide to the Process”, focusing on educating business owners on Exit Planning.

Julie enjoys spending quality time with her family, including her 8 children and 10 grandchildren.

Topics explored:

- Privately held business owners face the challenge of not being prepared for exit, which can jeopardize their liquidity.

- 10 years for family business transition, 2-3 years for non-family business sale.

- Business succession planning and key common mistakes to avoid.

- Emotional readiness is crucial for business owners transitioning out of their business.

- Entrepreneurs must be self-aware and courageous in their business journey, seeking proper advisors and upgrades as needed.

- Optimize businesses for sale with a focus on delegation and value growth.

- Owners should delegate tasks to make their business less dependent on them, increasing its value and appeal to potential buyers.

- Implementing free actions like delegating tasks can help owners think like potential buyers and increase their business’s value.

- Seeking professional advice in business can net significant financial gains, 10s, 100,000s, even millions in the difference

Transcript

Al McBride 0:02

Welcome to the dealing with Goliath podcast. The mission of dealing with Goliath is to sharpen the psychological edge in negotiation, ethical influencing and high impact conversations for business leaders who want to be more effective under pressure, uncover hidden value, and build greater connection all while increasing profitability. This is the short form espresso shot of inside podcast interview to boost business performance using our five questions in a roundabout 15 minute format. My guest today is Julie keys. Julie is a certified Exit Planning advisor and founder of key strategies specializing in excellent transition consulting, leveraging her extensive entrepreneurial experience understanding the challenges of ownership. She aids business owners in maximizing their exit and transition options. Julie is deeply involved with the Exit Planning Institute, contributing as a faculty member a leadership council member and is a two time recipient of epi as a thought leader of the Year Award. She is sought after speaker and in 2021, she released the second edition of poised for exit a practical guide for private business owners on the business exit process complemented by her weekly podcast available on major platforms offering insights for business owners and advisors. She has also developed an online course business transition readiness and owners guide to the process focusing on educating business owners on Exit Planning. Julie enjoys spending quality time with her family, including her eight children and 10 grandchildren. A handful right there. Julie, welcome to the show.

Julie Keyes 1:44

Well, thanks. So I sure appreciate being here. Thanks for inviting me. Took us a while to make this happen. But here we are.

Al McBride 1:51

Did it did it. Thank you. Yes, we persevered through all sorts of little setbacks and everything. So I appreciate you joining joining me for the on the show today. So let’s kick off. So who’s your ideal client, and what’s the biggest challenge they face?

Julie Keyes 2:05

Your ideal client would be a privately held owner of a business closely held owners of a business, sometimes family business sometimes found, you know, partners founders, and usually in the lower middle market space, which would constitute somewhere between maybe 10 and 100 million a year in revenue. Probably the biggest challenge that my clients face, while they face many challenges, you know, entrepreneurship is not easy. But they’re not prepared for their exit. And, and so they wait too long to take action, which really jeopardizes that nest egg. You know, the truth is, most business owners have most of their liquidity tied up in their business. Right? And if the business doesn’t transition, well, then the ripple effect of that is not good.

Al McBride 3:03

Pretty good. Because there’s a lot of you know, there’s a lot of listeners out there who might, this might not be on the top of their horizon right now. But as you say, it’s a it’s a few years down the line, whether it’s five years, 10 years, or whatever, it’s down there somewhere. And you’re talking about transition. So how long for you, as ID, you know, to put those markers in, because some people probably come to you and they want to sell it up in six months. And others people maybe it’s it’s a year or two or more. What What kind of do you need? What’s optimum for you? Yeah,

Julie Keyes 3:39

that’s a good question. I think that it really depends on the owner, and what type of transition they’re looking to accomplish. Like, say, for instance, if you’re a family business, and you’re planning to transition the business to a family member, and maybe that family member hasn’t had any leadership experience? The rule of thumb? Yeah, the rule of thumb is 10 years.

Al McBride 4:06

Whoa, okay.

Julie Keyes 4:09

Yeah, well, I mean, think about it, if I’m a 65, or 70 year old, founder of a business, and I have a son or a daughter in the business, who was 30, or something like that, and has worked for me for maybe 10 years, or eight years or whatever, but not necessarily in a CEO position. It takes a long time to groom that person to take over. And it also, you know, you got all the employees and we want to make sure that that the respect is there and, and that transition is smooth and it doesn’t damage the business. And that isn’t my rule of thumb that’s actually coming from many family business centers that are usually tied to universities across the United States. Yeah, that’s their rule of thumb. If you’re not a family business, and you’re just wanting to sell to a third party, perhaps a strategic buyer or a private equity firm, you could probably accomplish what you need to in two to three years. Okay? And, and, you know, the whole process of what that looks like is a little bit complicated. And it can be very time consuming. And so if you’re an owner who, who finds themselves in a position where you’re behind, you know, you haven’t had a legal audit for a long time, maybe your agreements are outdated, your estate planning is outdated, your buy sell agreement is outdated. You know, you don’t have your key people formally retained, you know, kind of the list goes on and on. And maybe you, you need to have an audit of your financials, because maybe the business has been paying a lot of your personal expenses. And buyers don’t like that. And it’s a three year look back, right. So that’s why we say two to three years, so that you can clean those things up, and have your best foot forward. Not just, you know, under the hood, but appearances too, you know, and, and doing all those things can be time consuming and expensive. Right? If you need to revamp your website, if you you know, the list kind of goes on and on there. So two to three years, I know long answer. But you know, it’s very common for an owner to say, Well, I’m ready. And maybe they’re emotionally ready. Right? But they’re, but they’re not ready.

Al McBride 6:29

Understood. So what are some of the common mistakes people make when they’re when they’re trying to, as you say, transition out of the business? So from what you’ve said, already, the major one is, was waiting too late, not getting in there a little bit earlier. And the more time they can give to get their business and affairs in order, the better but what are some of those other problems?

Julie Keyes 6:53

Well, like I alluded to the, the emotional readiness is really important. And, and for those who aren’t emotionally ready, because the business tends to be like their, their baby, you know, and, and, and so they they resist because it’s their identity.

Al McBride 7:14

Yeah, it’s a big thing. When the when that thing is your identity, it’s your it is your a lot of yourself worse, maybe is tied up in it as well. Yeah.

Julie Keyes 7:23

Yeah, just productivity, everything. And if you haven’t imagined what your life could be like without your business, and really honest, honestly, that should be the best part of your life, right? Yeah, we have to start thinking about what do we really want to do in our next act. When I talk to entrepreneurs, I don’t want to talk about retirement because most of them aren’t interested in retiring, they just want to go to the next thing, right? And so we just talked about what’s next, what are we going to do next and, and that takes a lot of introspection, and courage. And just being really self aware and, and realizing that, that it takes, this is another mistake that a lot of owners make, they don’t have the proper advisory, and they try to DIY. So if, if they’re finding that their accounting firm, or their law firm, those are the two primary resources that they’re going to be using right away. If they’re finding that those advisors no longer can support and advise their business because it’s grown to a point where they need an upgrade, then get an upgrade. Just do it. Because you know, you got one shot usually at doing this right? And you definitely don’t want incomplete or inaccurate information and you don’t want to leave money on the table.

Al McBride 8:41

And this just brings me very neatly to the next question God so thank you for that so because we’re let’s talk about the money on the table just to really bring this point home to any listeners who might be as you say, they’re thinking oh, that’s that’s years in advance. The earlier you go the better what’s what ballpark I know it’s like it’s a How long is a piece of string but with when you’re working with the business save for two or three years in advance to get all their affairs in order to get all the business primed and optimized for the buyer to be in such a great state that when they look at it, they go this is a beautiful business everything I can see everything it’s all set up ready how I want it they can see how they’re going to use it or they’re going to integrate that business or how they can run the habits profitable all those good things. Versus as you said, a business that doesn’t is not optimized what sort of scale of difference might we be talking about here?

Julie Keyes 9:43

You know, gosh, I hate to use depends, it depends. It depends right? But really, it does because you know, your your EBIT, a multiple on what you sell the business for can vary from industry to industry. And if your your business is smaller, like say, for instance, you’re, you’re more of what we call a Main Street business, say, for instance, you’re you’re under 5 million a year in revenue, which would be called a Main Street business, those businesses can sell. But they’re harder to sell, because they’re perceived as a higher risk. And if they’re a higher risk, then they’ll sell for a lower multiple. So anything that you can do to increase the value, and make it turnkey, less dependent on the owner, right, always will increase your multiple, I’ve worked with plenty of owners, even in the lower middle market, who are still running their business and making all the decisions and are the face of the business. And so so getting out of it makes it really tough, because there’s so much delegating, that has to be done.

Al McBride 10:47

Exactly. And that, again, leads me into the next question. Thank you, Judy, which is, what might be one valuable free action that the audience can implement that will help because it might not solve the problem, but they’re at least they’re thinking in the right way. And that’s a major one, isn’t it? Where they’re taking themselves out of the day today? So they’re if they’re far more, as I said, a potential buyer can see them being replaced far easier, shall we say? They’re not doing the day to day they’re not selling? Whatever the main thing they sell product or service?

Julie Keyes 11:19

Yeah, I think maybe one of the best things that that an owner could do, and really be honest with yourself. Okay. What would it take for you to be gone for a month? From your business? No, it really think about that. Who would have to take over? What would they take over? Do you have the people internally already in place that could, because realistically, something could happen to you, and you might be gone for a month, whether you want to be or not? Right? Every people get sick. The older we get, the higher the likelihood of getting sick, or in a car accident, or God forbid something like that would happen. And you’re away from work for a while. So somebody’s got to take over for you. Like more than maybe somebody right? You gotta let go of that control? Because that’s where you build the value in the business. And you deserve it.

Al McBride 12:18

Absolutely. It’s a great point is that what are the standard operating procedure? What structure is in place, as you say, for you to be able to step back for two weeks for four weeks for six weeks? How would that work? Absolutely. It’s a great, it’s a great question to get people thinking in that direction. Absolutely. And the more as you said, the more they can separate. Usually the business is in a in a better state for sale. Right? Absolutely. Excellent. So if so, what might be one valuable free resource that you could direct people to that would help them on this journey?

Julie Keyes 12:52

Well, a couple, one would be, they could go to my website and download my ebook that talks about the basics of the exit planning process, I have actually several free resources on my website that people can go to download. I have two websites, one of the key strategies.com And then poised for exit.com, where the podcast lives that’s free. And then several more resources for download on that website as well.

Al McBride 13:21

Excellent. And as I said, those will be underneath the video and indeed, the podcast as well, of course, great set of resources there. So I know you’re a regular podcaster. So there’s great value in that. So on that what would be your number one insight or principle on, on how to negotiate build rapport connection, or uncover hidden value for your clients?

Julie Keyes 13:48

Well, like I said before, don’t DIY. Big one. We, you know, when we’re on the inside, it’s very difficult for us to see the way things really are sometimes. And that’s what we need advisors for. And I think that having a good solid team of trusted advisors that can bring that perspective is worth everything. And yes, they cost money. But when you don’t have good advice that costs exponentially more. Exactly. And so that

Al McBride 14:21

is massive, right?

Julie Keyes 14:23

Yeah, it’s the potential is huge for a complete derailments. And I’ve seen it happen. And so don’t do that to yourself. Just get good advice. Start start the process. And that that would be that your eyes would be open, you’d learn a lot through that process. And as you’re doing that, then you’ll be able to make more clear decisions and good educated decisions are your best decisions. Because this is your life. Right? Not your life, just your life but your family, your employees. So so just dive in. And the you know, first step to a million mile journey is you know, is in your hands to take Some

Al McBride 15:01

standing stuff at sending stuff. And where can people find you? You mentioned the boys for Exeter comm website. Can people reach out to you on LinkedIn? You’re quite active on LinkedIn.

Julie Keyes 15:11

Absolutely. Lots of stuff going on on LinkedIn all the time.

Al McBride 15:15

Excellent. Course. That’s Julie keys on LinkedIn. And again, the link will be below this episode. Julie, it’s been an absolute pleasure. Thank you for coming on the show.

Julie Keyes 15:27

Well, thank you, Al. I sure appreciate it. You have a great show and wonderful to be here to share with your audience. Thanks very good.

Al McBride 15:34

Thanks again, Judy. Cheers.

Transcribed by https://otter.ai

Resources

Websites: https://keyestrategies.com/

https://www.poisedforexit.com/ and book link

Online Course, “Business Transition Readiness: An Owner’s Guide to the Process”

Julie’s Poised for Exit Podcast: https://keyestrategies.com/podcast/

Connect with Julie Keyes

You can reach her at: julie@keyestrategies.com

Ready for more:

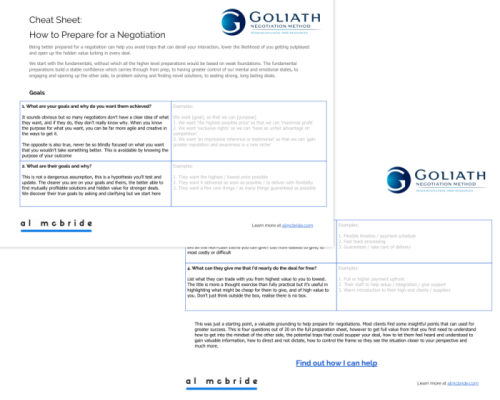

If you’re interested in more, visit almcbride.com/minicourse for a free email minicourse on how to gain the psychological edge in your negotiations and critical conversations along with a helpful negotiation prep cheat sheet.