Improve Your Company Through Business Exit Stories with Marvin L Storm #052

Show Notes:

Marvin L. Storm is my guest today. He has founded, acquired and scaled businesses over the past four decades and hosts the Business Exit Stories Podcast, where he interviews, merger and acquisition advisors and other transaction professionals who share stories on their deals, for those who are thinking about selling their businesses. He serves on numerous company boards of directors and consults on exit strategies.

Topics explored:

- The surfboard metaphor for business opportunity

- Experience starting businesses and experiences acquiring them, improving them and selling them

- Add value to help get those exiting a business more dialled in and prepared

- The dangers of different motivators of private equity investors compared to entrepreneurs

- The podcast: Not the focus on the entrepreneur, but the pros who do this week in, week out, for the benefit of the entrepreneurs

- Marvin’s 4 Key Observations

- Fallacy: Entrepreneurs believe that because they’ve worked hard to build their business, it’ll be worth a lot of money when they go to sell

- Why business owners need to do something about this now, not later!

- You need to know a potential buyer’s due diligence checklist

- It’s the thought process and planning, not the time that will pay

- Would you write a check for cash and pay what you’re asking for your own business?

- Things that will cause a depression of the value of your business

- Doesn’t take a lot of time, but it does take strategic thinking

- The exceptional value of predictable revenue

- An advisor can literally make or break the valuation on a business

- How entrepreneurs realised sales at multiples of their first offer

- The importance of differentiation and creating a moat for competitive advantage

Transcript

Al McBride 0:04

Welcome to the dealing with Goliath podcasts. The mission of dealing with Goliath is to sharpen the psychological edge in negotiation, and high impact conversations for business leaders with skin in the game, who want to be more effective under pressure, uncover hidden value, and increase profitability. With expert guests across the business spectrum, we deliver gems of wisdom, delving into their methods, their thinking and approach to business life and to problem solving. This is the Grande cup of insight, the long form podcast interview, where we take the time to delve a little bit deeper into our guests experiences stories, and to get those priceless nuggets. I’m your host, Al McBride.

Al McBride 0:44

My guest today is Marvin L. Storm. Marvin has founded acquired and scaled businesses over the past four decades, he hosts the business exit stories podcast, where he interviews, merger and acquisition advisors and other transaction professionals who share stories on their deals. For those who are thinking about selling their businesses. He serves on numerous company boards of directors, consults on exit strategies. And as a frequent speaker, exit coach, author and podcaster. Marvin, great to have you on the show.

Marvin L Storm 1:23

Well, I’m excited. I appreciate you inviting me and I’m looking forward to our discussion here.

Al McBride 1:28

Absolutely. Well, as it was just saying to you before we before we began, I’ve really been enjoying your podcasts, I can thoroughly recommend it to people. It’s a lovely format, the two positive and two cautionary stories before we get into that format, because I thought it was very evocative, very valid. Tell us your own origin story tell us where all this interested in exit strategies and even having a podcast on a came from?

Marvin L Storm 1:57

Well, it’s been a long, interesting road, I guess from my perspective, I, you know, got my degree and accounting, I have always been sort of entrepreneurial, I grew up in an entrepreneurial family, my father had his own business. My mom was kind of the office manager bookkeeper. So when I was growing up, I kind of was able to see, you know, the, the peaks and valleys of the entrepreneurial journey. My dad didn’t, you know, actually graduate from high school here in the States. And, you know, he kind of wanted, you know, as all parents do something a little bit better for their kids and wanted me to go on and get an education and, and so I pursued that path. And, you know, in college, I had that entrepreneurial yearning, I started a few businesses in college, and that was really what got me into accounting, one of the businesses kind of took off on me.

Marvin L Storm 2:58

And I had a lot of accounting and cash flow issues, I had money coming in, and I was, you know, working hard, and I was almost going to have to drop out of school, you know, to keep up with the business. And I had to kind of make a strategic fork in the road decision early in my, you know, career as an entrepreneur because I had to decide, well, maybe I should drop out for a while and ride the horse, wow, that was going fast. And they made the decision actually to exit that business and sold it to some of my employees and let them take over and I went back to school and, and that’s why I started I was actually, you know, has a general business major. started focusing on accounting, and some accounting classes, which led to actually going to work for national CPA firm here, one of the big eight at the time. Now one of the big four, Deloitte, what

Marvin L Storm 4:00

I was playing pickup basketball, you know, after work, did that for a couple of years, and met a guy there that we just started talking and became good friends. And through that process, we ended up turning in our resignations, and rented a small office in downtown high rise and like 300 square feet and got a couple of desk and some phones and put the desks facing each other and we were in business and we we had a great ride. We were sort of in the right place at the right time. And I’ve often used the metaphor of a surfboard, you know, a surfer. The wave was coming and we saw the wave and we had surfboards and we got up or had enough brains to get up on the surfboard and we had a good ride. But as things always happen, the market changed.

Marvin L Storm 4:59

The economy has it’s fluctuations and customers that used to show up without even us trying to find them, all of a sudden, weren’t as coming as frequent. And so we had to figure that out. And we did. And we was it was a great ride. But as businesses and people that entrepreneurs that run businesses, goals and objectives, change your work hard, you know, those 12-14 hour days, kind of gets old, and my partner kind of wanted to go in one direction, and I kind of wanted to go in the other and, and we decided to step away from the business and exit. And that was my first real experience of stepping away from a business. And so from there, I got involved in another business and a startup situation and launch that business. And that led to a series of other entrepreneurial ventures until I acquired a instead of launching when I actually acquired an existing business that had its issues, I was serving on the board of that company at the time.

Marvin L Storm 6:12

And they approached me and wanted to know if I wanted to actually assume control of the business. And I thought about it, and I did and, and then so that business involved a little bit different scale and some different challenges and problems that I hadn’t experienced before. And that was really the issue of bringing in outside capital, I had private equity involved. So I had a board of directors I had to answer to, and being an entrepreneur, that was a new experience of having to report to somebody else and be held accountable for your performance, and not just being able to make decisions on your own. You had to clear them and get approval and submit budgets, you know, plans and, and, but I was able to, you know, do fairly well in that environment and figure it out and grew the business actually spitting out a division and starting a parallel company with that, and and one of the things I intellectually understood was that when you take outside capital, you really start a time clock.

Marvin L Storm 7:27

Because private equity and other institutional investors, they have their own set of goals and objectives, and they want to monetize their investment, when I understood that intellectually. But in real time, when it was happening, when the time arrived, and a board meeting where they said, you know, we’re now starting to look at the monetization event and exit, we need to, we’re going to sell the company, that was a blow. I knew it was coming. But when the reality arrived, I wasn’t ready, I felt there was a lot more that could be done, we could greatly increase the value if we could just, you know, continue to operate and scale the business. But that wasn’t in the cards. And so I went through that process and exited the business. That was a few years back. And

Marvin L Storm 8:24

I thought I would, you know, do what a lot of entrepreneurs want to do. And, you know, get out of the fast lane when you have the pedal to the metal. And, you know, get into the slow lane, take it easy enjoy life. And so we moved from the San Francisco Bay Area where I’d spent most of my career up into the country, which is I don’t know, your audience is familiar with California, northern California, specifically, but there’s a place called Lake Tahoe, which is one of the larger lakes in the US and Florida. But Nevada there moved up to that foothills on the way up to that lake, I thought I would spend a lot more time skiing. You know, you know, kind of enjoying a little slower pace of life and didn’t do a lot of skiing. I’m getting a little bit older now. And the Black Diamond runs aren’t as appealing as they used to be. And anyway, to make a long story short, I sort of got bored and started thinking about my the experiences I’ve had in my career.

Marvin L Storm 9:28

I’ve been asked to serve on a couple of other boards of directors of companies and, you know, saw a little bit about the opportunities there to position companies for a future exit event and got to thinking about my own experiences. And there’s thought there’s probably a lot of other folks out there like me, that if they’d have been a little would be a little bit more dialed in and prepared for the actual process of exiting a business I’m probably could add some value. And so I love podcasting. I listened to a lot of podcasts, specifically business oriented podcasts. And so I, I did, I just jumped in and launched a podcast and decided to do a little bit different times they listen to the different podcasts out there, I decided I would actually interview the people that make deals happen that the silicate the actual transaction, to help an entrepreneur, monetize his business,

Marvin L Storm 10:35

a lot of podcasts, you know, focus on the entrepreneur and the entrepreneur tells their story. And so I decided that these professionals out there, the investment bankers, wealth managers, CPAs, Business Brokers, m&a advisors, these people spend every day all day long, working with entrepreneurs, and they do dozens, if not hundreds of transactions in their business and careers over a period of time. And they have some really interesting stories, good ones, great ones, that were entrepreneurs who are able to create a phenomenal exit and make a ton of money when they exit it and, and then they share some, you know, stories that didn’t all go that all that well, and the share the takeaways of why that happened. And really, quite frankly, some really sad stories, entrepreneurs that spent decades building their business and on the last lap, dropped the baton.

Marvin L Storm 11:42

And not necessarily failed to exit, although there were some of those, there are some of those, but got a lot less than they should have gotten. And what I’ve concluded after interviewing all of these professionals, and the hundreds of stories that they’ve shared, is that every business, if you do the right things can have a much better outcome than you could ever imagine. If you just follow a specific plan and strategy and implement some tactics that aren’t all that difficult. It isn’t rocket science, necessarily. But you have to do the right things in order to monetize your business. And so that’s kind of what I’m doing now. And I really enjoy it. I’ve met a lot of great people learned a ton of insights and concepts that every entrepreneur should actually understand and know.

Al McBride 12:43

Absolutely, I mean, I liked your four key observations. And I’ll just read those for the audience now, because I think that they’re critical. And I want to I want to dive deeper into into most of them. Firstly, that entrepreneurs often spend decades in our lifetime, as I said, with their nose to the clients are working so hard, and often give little thought to actually positioning their company for an eventual profitable exit. The too many entrepreneurs believe that a profitable exit will magically happen, when it’s time to sell their business. Entrepreneurs believe that because they’ve worked hard to build their business, it’ll be worth a lot of money when they sell.

Al McBride 13:20

And this is also a fallacy. And lastly, successful exits happen, when there is a plan to ensure the business is appealing to a buyer. So there’s just a few areas to go deeper into that because one of the things that keeps coming across is that the earlier you can get an entrepreneur, aware of selling their business, the better position they’ll be. So if an entrepreneur says, Marvin, I love your podcast, I love the idea of getting my business ready to sell. But you know what? I’m working all the hours I can. I’m fully focused on growing the thing on serving paying customers and clients. Can I not just deal with this in a few years time? What would you respond to that entrepreneur?

Marvin L Storm 14:06

Well, actually, you’ve hit on a real important concept here. And I get questions all the time. You know, when I you know, in front of a group talking could be a small group or a large group and, and I get a question from the audience or someone that’s listening to the virtual presentation nowadays. And they ask the question, yawn. I’m so busy building my business, I don’t have time to think about selling it, that’s going to happen 5-10 years down the road. I don’t have the time to think about it. You know, I’ll just I’ll worry about that later. And I appreciate that. I’ve been in that chair. I understand the rapid fire decisions that you have to make on a day to day basis and the fires that you have to put out and then Think about selling your business years down the road, it just has a cognitive disconnect, you know, it just doesn’t make a lot of sense to, you know, people who are in the thick of it who are in the heat of the battle is just not something that they want to think about right now.

Marvin L Storm 15:20

But I can tell you, from my own experience, and from the experience of these hundreds of other stories that are shared on my podcast, that is a flawed philosophy, a flawed thinking process. If you don’t start thinking about it, you’re not going to be able to optimize unless you get really lucky. There are situations where you don’t have to do a whole lot, and you happen to just, you know, be lucky and be at the right place at the right time. And someone comes along and offers you more than you ever thought you were going to get for your business that does happen. Rarely deny that, but the data and the statistics, and the probability of that happening is very minimal. And so if the probability is not that great, then you should probably start thinking about what that means. And here’s the point that I think most people miss most business owners, entrepreneurs founders miss. And it is that it doesn’t necessarily take a physical investment of time, so many hours a month or a year that you have to invest in positioning your business and thinking about positioning it and getting it ready for sale years down the road.

Marvin L Storm 16:47

It’s the actual thought process, if you are aware that it’s going to happen, and that you need to be aware of certain types of things that you do on a day to day basis. And let me share a couple of examples with you please do on the podcast. There’s a story about a transaction, a person that was in the head retail had a retail location, a phenomenally successful business in the retail sector, and had been in business for over 25 years. He the business was located in a marquee building a center, it was called the Pioneer center. And everyone in the area miles around 100 miles around knew, you know what the Pioneer center was and that that business was located there. And it was really became kind of a destination oriented business not only for the local community, but for people that would be visiting the community, tourist and others would find their way to this location. And phenomenal margins, not a lot of money spent on marketing. It was just a great reputation. Premiumly price products, exceptionally profitable business. And there were some health issues and things that really motivated the entrepreneur to start looking to sell the business. And his landlord was a personal friend. And they had negotiated lease, you know, 25 years ago, and every five years lease had come up for renewal, and they would just execute a new lease. And it was very routine, the leases weren’t reviewed by an attorney, none of the provisions or terms of the lease were given much consideration. It was just a routine thing every five years, the rent would go up a little bit. And, you know, when it came time to think about selling the business a couple of three years in advance, there were a lot of things done properly, as the business was, you know, being prepared for a sale. And as the

Marvin L Storm 19:08

they invited an m&a advisor in to facilitate the process and to help with with the transaction. And the process involved, you know, looking at the lease, and so the buyer came to the table and his attorney came to the table. And they noted that there was no assignability clause or provisions to assign that lease and so a new lease was going to have to be executed because the existing lease was non assignable. Well, that’s where the issue started. Or the landlord now because the market had changed and we had they were in a kind of a booming economy at the time. And when it came time to renegotiate renegotiate the lease, the landlord said, Sure, no problem. Here’s the new lease.

Marvin L Storm 19:55

Unfortunately, that new lease was triple the rent and Um, you know, I’m fairly confident and the advisors was fairly confident that if the lease had been negotiated, you know, a couple of three years and that provision had been addressed at that time, the assignability clause would have probably been agreed to, and everything would have, you know, this move forward, and there would have been a provision in there, but when a new lease had to be signed under the current conditions, that became a big deal, because and I’m just going to use some numbers here, to give an illustration, let’s say that business had a $200,000 net profit and the multiple on that profit for valuation purposes, let’s say was five, and so you take five times 200,000, that’s a million dollar business.

Marvin L Storm 20:53

Well, the lease was $100,000. And the lease tripled. So that that meant that the business valuation would drop. And that was hundreds of 1000s of dollars in decrease in the value of the business, because of the multiple that was associated with a drop in profitability. And so that really caused some real heartburn and long story is that the deal did get closed, but at a fraction of the cost of what the entrepreneur was really attempting to extract the value out of the business. So that wasn’t necessarily you invested a lot of time. But what it was being aware of the thought process, the actual, that you need to be concerned with a lease, similar types of things with employment agreements, and vendor agreements, and all these other things that don’t take a lot of time to focus on. But you need to be aware what the actual buyer is going to be concerned about, when it comes time to, you know, for them to look at their checklists, their due diligence checklist, if you’re aware of those things you can create, remove a lot of obstacles and problems in advance.

Al McBride 22:16

Excellent, it sounds like an awful lot of the planning. As you said, with the mindset of having potential exit in mind down the line, a lot of the planning makes for good business planning anyway, even if it’s another 510 20 years down the line before you actually ever sell.

Marvin L Storm 22:36

That’s absolutely true. It’s the actual planning. And again, I want to emphasize is not necessarily time. So when I get this question, I don’t have time to worry about selling my business in the future. It’s not the time, it’s the thought process, it’s being aware of what a buyer is going to be concerned with down the road. And you just you just have to sort of understand that. And if you do understand that, then you can do things in advance that don’t take a lot of time. But it’s all about strategy and positioning.

Al McBride 23:14

Let’s dive a little bit deeper into that. I mean, that what there must be 50 things you could do but with everything that’s usually an 8020. So what are some of those most the biggest, most common mistakes or things that a business owner overlooks that, as you said, with a bit of awareness, they can start maneuvering their business that little bit better for when they eventually may might want to sell it, what are some of those big things they can do differently? That things that make the biggest difference? You know? Yeah, well,

Marvin L Storm 23:45

some of the things that I guess the way I would answer that question is, this is not rocket science. Okay? It’s this is some pretty fundamental business ideas and concepts. It’s just that an entrepreneur by their very nature and personality profile, they focus on you know, an entrepreneur generally likes to focus on, you know, growing the business making decisions in real time, overcoming problems, identifying problems, you know, figuring out the solutions to those problems. And because they are able to do this and they get really good at it, they become almost experts at their business and understanding it and understanding keeping their hand on the pulse of the market. And they’re just really good at what they’re doing and they become good at what they do. It is really because they are able to hone their skill in their decision making skill and their problem solving ability. And they falsely, you know, project this into the future and

Marvin L Storm 24:59

When it comes time to sell their business, they’ll do the same thing, they’ll just figure it out, unfortunately, that doesn’t work very well, is because you’re dealing with a third party that’s going to take a microscope to your business, and question everything that you’ve ever done. In your business, it’s kind of like getting a colonoscopy, they’re going to do a deep dive into your business to understand where the skeletons are buried. And they’re not going to believe if you’re selling to a third party, they’re not going necessarily to believe that you have a great business, they’re going to want to validate that you have a great business. So they will look at every aspect of your business and challenge every thing that you think is sort of obvious. And a lot of entrepreneurs become offended, that they aren’t believed, or that they’re being questioned and have to produce all this documentation.

Marvin L Storm 25:56

I mean, I certainly went through that I was a little perturbed that I had to big up files that what I considered relatively irrelevant, but for a buyer, they were not irrelevant. And so you have to kind of be aware of that due diligence checklist. I’ve often asked entrepreneurs, knowing what you know, about your business? Would you write a check for cash and pay what you’re asking for your business, because most entrepreneurs overvalue their business, they want a lot more for their business. And it’s actually worth, when you ask them that question, then I, you kind of get the shuffling of the feet, and people look down at the desk and say, Well, you know, quite frankly, I don’t know, if I would, I would write that check for my business. And yet, they’re expecting somebody else to do just that. And so when you put your self, when a founder entrepreneur puts himself in the chair of a buyer, and tries to see their business, in the eyes of a buyer, it does change the perspective a little bit. And so you start looking at things, and I’ll just go through a couple of things here. One of the things that a buyer is going to be concerned about is really the type of customers that you have, who your vendors are,

Marvin L Storm 27:29

and kind of the mix of your employees, you know, and they’re going to look and have a checklist that they’re gonna want to know, let’s say, let’s take all those three things that I just mentioned there, they’re going to want to know a little bit about your customers, what type of customers do you have? How did you acquire those customers? What’s the customer acquisition costs the bringing on a new customer? Do you have customer concentration? One really far out example of a business that was doing had growing hyper growth was except you know, really profitable because of the scale that they had in their growth. But when you peel back the onion, they had one primary customer, a big box retailer, that was their primary customer that had over 90% of the revenue over time, was gradually focused on providing and meeting the needs of this one customer.

Marvin L Storm 28:30

Now that may seem great, because since very fragile, extremely profitable business, making boatloads of money, but for a buyer, having one customer control your destiny, and for a banker, or a financing company that’s going to underwrite that transaction and loan money on that transaction, having all of the revenue concentrated on one customer, I mean, that’s an extreme example. Generally speaking, if you have 20, or 30%, not 90, but 20 or 30% of your revenue concentrated in one customer that’s considered exceptionally high risk. And with risk comes depression of value, it will depreciate the value of your business. It will, if they if people are willing to pay for the value, they’re going to change the terms of that transaction. They’re going to want to hedge their bet in case something happens to that a customer so there may be a huge hole back in the purchase price for a period of years. A lot of things will have worked for concentration of customer or you take a vendor right now, you know post pandemic here.

Marvin L Storm 29:49

When we’re having this discussion, if you go to the west coast in the US, there are ships filling all the ports in the on the west coast because they can’t get them unloaded because of the lack of labor and the conditions of the longshoreman who actually are charged with unloading those container ships. There’s a huge backup, and it’s caused big problems in the supply chain. Absolutely. And, you know, when a customer looks at that, that all of your vendors are overseas and located in one country or with one company in those countries. That’s risk. And that’s being played out in real time right now. And so they will look at that. And so you may want to consider the type of vendors that you have suppliers that you have, you may want to spread over a number of suppliers, instead of getting the best deal you can from one specific vendor. And employees, if you have a key or several key employees that are absolutely critical to the operation of your business, and you don’t have them tied in with employment agreements, and if they aren’t really happy and well compensated. That translates to risk for a buyer.

Marvin L Storm 31:03

So you know that I kind of look at this as kind of an addiction to certain components of your business, because it makes sense financially. So you focus on one, one or a small group of customers, you try to get your volume up with one vendor, so you can get better terms, or you, you have a couple of key employees, and you don’t, you want to squeeze more profit out through yourself as a founder, so you don’t pay or don’t have the benefits to keep those people loyal to you. All these things translate into risk. And again, I’ll come back to my original point, it doesn’t take a lot of time to focus on those type of issues in your business.

Marvin L Storm 31:49

But it does take strategic thinking, and it does take preparation to correct the ship before you get to the point where you’re going to dock that ship and start unloading all the value that you’ve created in your business, you make sure that all those things have been addressed far in advance, so that a buyer doesn’t have those concerns. And then the buyer with lower risk will pay you what you need for the business and will not have draconian terms on being able to acquire the business, the type of revenue and other issue

Marvin L Storm 32:25

the type of revenue that a company generates, if you have one off type of revenue, and I’ll use the example of a moving company, for example, right? If you had a moving and storage company, and someone is moving, whether it’s a commercial move or residential move, they give you a call. And they want you to move them. Well, that’s great, high profit, high margin business, very profitable type of business. But once you’ve dealt with that customer, they’re not going to move for another 10 years, and they may even move out of the area, so you’re never going to see them again. That means that the type of revenue you have is very dependent on customer acquisition. And that translates into what that cost is.

Marvin L Storm 33:14

Now if you have a different type of business and you have reoccurring revenue, that is repeatable, customers sign up for a long term contract, dealt with a company not too long ago that was in the heating and air conditioning, business. HVAC business. And they at one point in their business evolution, they were probably one off when they would get cold or hot, their business was booming. And when it wasn’t cold or hot, their business kind of plateaued and took a dip, you know, and it was kind of a feast or famine type of situation. Well, they decided that they would, because it created real problems for them to service customers. They started offering maintenance contracts that they would visit your home or business three times a year. And they would check the air conditioning and cooling systems and the heating systems, tune them up for the season. And if anything went wrong, if you were on a maintenance contract with them, you got preferred service, they would put you at the front of the line to resolve your issue for a commercial business who has customers coming in and the air conditioning or heating isn’t working is a big deal. And if you can get preferential treatment on that.

Marvin L Storm 34:37

That’s valuable. And so people were signing up for these reoccurring revenue every year they wrote a check for 1000s of dollars to get their maintenance contract in place. And that really leveled out the type of business so that business’s value went from, you know, three or four acts of profit revenue of profitability on revenue to eight or nine times x, because the revenue was predictable. It wasn’t one off type of revenue, there was that type of revenue, but it was a smaller proportion. And so their business became much more value.

Al McBride 35:12

And very interesting. Again, this this idea of risk on one end versus predictability on the other, which is very interesting. It sounds like as a some people want to reduce fragility and reduce risk, are you I mean, you you’ve sold a number of businesses, as you said, and I think you’ve mentioned you’re on the other side, where you’re helping with the business being acquired. When you started doing the podcast, what were some of those surprises that hit you, when you were interviewing? The people who, as you say, Do this day in day out, because as I said, your knowledge was quite substantial, even at that stage. But what were some of those, the insights that you took you by surprise,

Marvin L Storm 35:59

just the complexity of different types of businesses, you know, businesses may seem to be rather mundane or routine. But the complexity of a transaction, an entrepreneur often gets into the frame of mind, because they’re so familiar with their business. Because they’re knowledgeable on the industry, or the vertical that they’re in, they don’t really appreciate, you know, the complexity that their business has to somebody else, and all the things that can go wrong.

Marvin L Storm 36:38

One of the things that, and, and entrepreneurs are just a slay, they think that they, as I mentioned before, they think they can just figure it out. Yeah, and they don’t appreciate the value that an advisor will bring to the table. Just it’s amazed me that. And because I understand this, because it’s part of the entrepreneurial thinking process is the problem solving aptitude. And an ability that entrepreneurs develop over time they use, one of the things that was a surprise to me is that the value that an advisor can bring to a transaction. And they can literally make or break the valuation on a business because they do this every day, all day long. And they know how the transactions should unfold.

Marvin L Storm 37:40

And, and being anticipatory in being able to position a business and having the right advisors and I mean, your m&a advisors or investment banker, business broker, but also your attorneys and the financial advisors if you have your CPA, or your CFO that you need to have in place to, to be able to address the issues of the people on the other side of the table for your business. I’ll give you a story. A a business was, you know, if you have a business, you will get inbound calls, from people who are looking to buy your business, it may be another company that’s looking to buy a business in your sector, it may be a private equity firm, or someone that’s looking just doing prospecting. They may or may not be serious.

Marvin L Storm 38:30

They’re just, you know, cold calling companies out there. And I used to get these calls a lot. And most of the time, I wasn’t interested, while this one individual got an inbound call. He’d been in his business for nearly 30 years, he was just starting to think about exiting his business. And he got this call from a company in the in the business in his sector. And they were very interested in these business. And he knew them, he knew their reputation. And so he took it seriously. And he opened up a dialogue with them. And they actually went to the term sheet phase where they were moving toward a close buying this business. And for illustration purposes, I’m going to say again, the business was, let’s say worth $5 million. And

Marvin L Storm 39:22

they were moving towards closing and then COVID hit. And of course when COVID hit everyone took a step back and say well, we got to figure out what’s going on here. And everything went into slow motion at that point in time. And the buyer went into slow motion and said no, we’ll we’ll kind of get back to you. Well, the seller was in the frame of mind. He was all teed up and ready to sell. And so he went out cuz he was doing this all himself without any outside counsel or advisors. And so he reached out to an m&a advisor got the m&a advisor involved and the m&a advisor took a look at these businesses says what we need to do As a little bit of repositioning here, we need to look at different types of buyers out there.

Marvin L Storm 40:05

And so they spent three or four months, you know, kind of repositioning the business on who the business was going to be of interest to. And then they went to market. So this is nine months after the first buyer went away, the m&a advisor went back out to the market with the company and they brought some other people private equity type of people to the table, and went back to the original buyer, and approached him to see if they were still interested. And of course they were, but they also contacted some of the competitors to that advisor, and brought them to the table. Well make a very long story short, what happened is that original buyer was so concerned that one of their competitors was going to get the business that they wrote a big check, three times the amount that they had originally offered, because they were so concerned that the buyer competitor was the buyer was going to be a competitor. And they wanted to box him out and didn’t want him to get the business and they were willing to pay up. So the financial metrics went out the window. And that seller walked away with a lot bigger check than if he had handled the transaction on its own and close a deal. You know, at x, and he got three acts

Al McBride 41:31

is sort of 515 Yeah. And it’s a great piece of negotiation as well getting in those other parties where, as you said that the normal metrics suddenly didn’t apply. Because it sounds like they they could it was worth us not just for the business, but preventing, as you say, their competitors from having that advantage. What was probably the justification for it fascinating stuff. One of the things I really enjoyed and picked up from some of the earlier episodes were the creative problem solving ability. So yes, they’re very strategic, a lot of these advisors but there’s also an interesting creative process. And one of the ones that springs to mind. And that was there was a client who I think they were in heavy construction.

Al McBride 42:19

And so they had a large amount of assets with the machinery, which changed the valuation from instead of being the turnover, it was because it was valued as a multiple of the assets. So your advisor, interviewee advised to sell off those assets, take that profit, and could actually improve the value. Because then you could add in the revenue multiple, which was fascinating, just as you said, someone who knows their job inside out, and was able to see that potential and really substantially increase the value that the or the the sale amount that the that the business owner received in the end was quite something

Marvin L Storm 43:09

Well, if that’s just one of many, one and one to many strategies, tactics that non you know, a founder, business owner needs to really be aware of things that you just wouldn’t normally think of, you know, it’s just not a part of the normal thought process of how you value a business or how you position it to create value for somebody else. It’s just a process again, I’m not trying I don’t want to overcomplicate or create a lot of mystery and as I commented before, this is not rocket science but it there is a specific process that you can follow to position a company profitably for an exit

Al McBride 43:57

absolutely and I would recommend everyone to I know you have a book coming out next year called pack your parachute how to double the amount of money you put in your pocket when you sell your business. But there is an overview report on that and I thoroughly recommend everyone who’s interested to go to business exit stories comm slash report to and I’ll have of course that link beneath the beneath the podcast and the video. You because he used parachute as an acronym that we don’t we’re just finishing up here. We don’t have time to go into each one. But one of the ones I particularly enjoyed was adopted different was one of the A’s which was adopted differentiation strategy to create a competitive moat. So you talk about competitive advantage. And you touched on Blue Ocean Strategy. Can you talk to us about what kind of a difference that can make? What format that can take for for a business owner Well,

Marvin L Storm 45:02

this whole concept of competitive advantage is not new. It’s been taught in business schools for for decades. But it’s never necessarily put in the context of an exit strategy. It’s really creating, you know, differentiation, your product. So you can charge higher margins. And yeah, that’ll all roll into an eventual evaluation of your business. But if you really think about this, from a tactical strategic point of view, the buyer who is eventually going to be writing a check, that’s, that translates into less risk, if you can turn a competitive advantage, whatever that may be, the competitive advantage may be price, it may be the amount of time it takes to deliver the the product or service if you know the turnaround time to get that product or service to you.

Marvin L Storm 46:03

It may be, you know, the ability of the your expertise, because you have specific knowledge that nobody else has whatever that competitive advantage if you can convert that into even a bigger company competitive advantage, and create a moat. And this is one of the things that Warren Buffett talks about. And he look, looks at or values a company, he focuses on companies in the industry that have developed a competitive moat. One of his largest holdings in his portfolio with Berkshire Hathaway, is Apple computers, that’s one of his largest investments in the company side. And the reason he likes Apple is because of their competitive moat, the ecosystem that they’ve created.

Marvin L Storm 46:57

Once you get into the Apple ecosystem, you’re kind of locked in, and that will lock out other competitors and create a lot of stability. In in the business’s future revenues, if you can manage to do something like that, in your business, through expertise through pricing through you know, a competitive advantage on location that where you’re at, or the type of equipment that you have available for your customers. You know, that translates for a buyer into less risk down the road. And less risk, increases valuation less risk, reduces the type of terms that you have. And so thank you thinking about where your competitive advantages are, and then focusing on those competitive advantages, making them either greater, and maybe even turning them into a competitive moat where, you know, competitors have a very difficult time, you know, penetrating the market or securing customers away from you. Most people don’t think in those type of terms of down the road of what that competitive advantage is going to mean to a buyer.

Al McBride 48:14

It’s a great observation. And as I said, whether you’re selling ready to sell or not, that’s going to improve the performance of your business anyway. You know, in the medium term, there are huge advantages and in taking a lot of these strategic steps. So the your podcast is called the Business exit stories podcast. And as I said, it was quite compelling, largely because of the story nature of the podcast. It’s a very, it’s a very lovely way, way to arrange your podcast. But as he said, it’s these professionals telling their, their war stories, so to speak. And it’s very, very easy to listen to, and very, very much what would you say? Your I was certainly learning by almost by by accident by osmosis, and a lot of insights and a lot of a lot of surprises in there. So I thoroughly recommend to anyone who will do who’s interested in business strategy and what makes businesses valuable, let alone easier to sell. So on that note, Marvin, thank you very much for a great conversation. And good luck with the book. Well, this

Marvin L Storm 49:28

has been delightful. You know, I really appreciate the opportunity, get passionate about this. And, as you said, an entrepreneur founder works decades, if not a lifetime. You don’t want to drop that baton on the last lap. And so it does take a little bit of insight to begin thinking in advance, be able to optimize that value. So I’ve been a I appreciate the opportunity to share my enthusiasm To help entrepreneurs monetize their value

Al McBride 50:04

absolutely thank you for your stories and for those insights a huge value there so great to have you on the show today moment thank you so much

Marvin L Storm 50:12

All right thank you for inviting me thank you

Transcribed by https://otter.ai

Resources

The Business Exit Stories Podcast:

or go directly to Apple | Audible | Spotify

Free Report: How to Double the Amount of Money

You Put into Your Pocket When You Sell Your Business

Four Key Points:

-Entrepreneurs often spend decades, if not a lifetime, with their nose to the grindstone and often give little thought in positioning their company for an eventual profitable exit.

-Too many entrepreneurs believe that a profitable exit will magically happen when it’s time to sell their business.

-Entrepreneurs believe that because they’ve worked hard to build their business, it will be worth a lot of money when they sell. This is a fallacy.

-Successful exits happen when there is a plan to ensure the business is appealing to a buyer.

Connect with Marvin L Storm:

On LinkedIn: Marvin L Storm

Visit his website at: https://businessexitstories.com/

Ready for more:

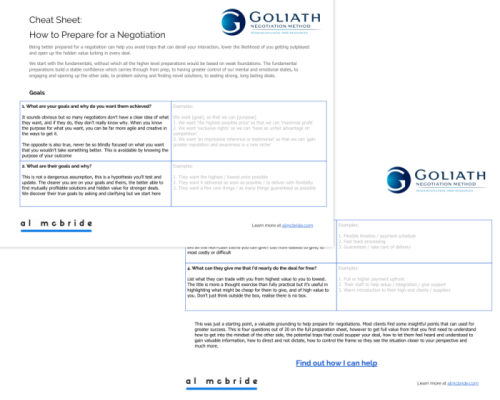

If you’re interested in more, visit almcbride.com/minicourse for a free email minicourse on how to gain the psychological edge in your negotiations and critical conversations along with a helpful negotiation prep cheat sheet.